GST (Goods and Services Tax) was introduced in India from 1st July, 2017. The introduction of this new tax reform brought revolution in the Indian Indirect Taxation system. Although now, GST is a 3-year-old tax reform now, but sill there are many controversial issues which are raising difference of opinions in business world.

One such issue which have always been a topic of discussion since the service tax era is applicability of indirect taxes(S.tax/GST) on director’s remuneration paid by company under reverse charge mechanism. The said issue was handled in the service tax era but with the applicability of the new GST reform, the issue again raised controversies among the business houses.

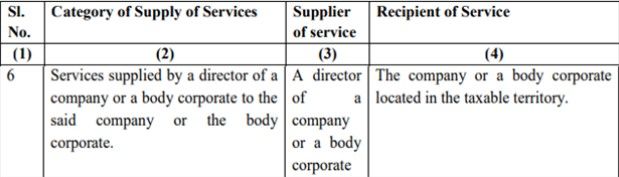

The government vide its Notification No. 13/2017- Central Tax (Rate) dated 28th June 2017 has notified the list of services under which GST will be applicable under Reverse Charge Mechanism(RCM). Entry No. 6 of the said notification reads as under:

Further, Schedule III of The Central Goods and Services Tax Act, 2017 provides that Services by an employee to the employer in the course of or in relation to his employment shall be treated neither as a supply of goods nor a supply of services.

There were difference of opinions prevailing in the industry that all remunerations whether paid to whole time, executive, non-executive directors etc. might be chargeable to GST under RCM. Many representations were made before the government to clarify on this burning issue for assistance.

Recently in April 2020, Rajasthan Authority of Advance Ruling in case of Clay Craft India Private Ltd has given ruling that, GST is payable under RCM, on Salary paid to director under reverse charge vide entry no 6 of notification no 13/2017 Central Tax (rate) dated 28-06-2017.

Further in May 2020, Karnataka Authority of Advance ruling in the application made by Mr. Anil Kumar Agarwal held that GST would not be payable on the remuneration paid to an executive director of a company as such engagement would be in the nature of employment. However, GST under RCM will be applicable when the salary is paid to non-executive director.

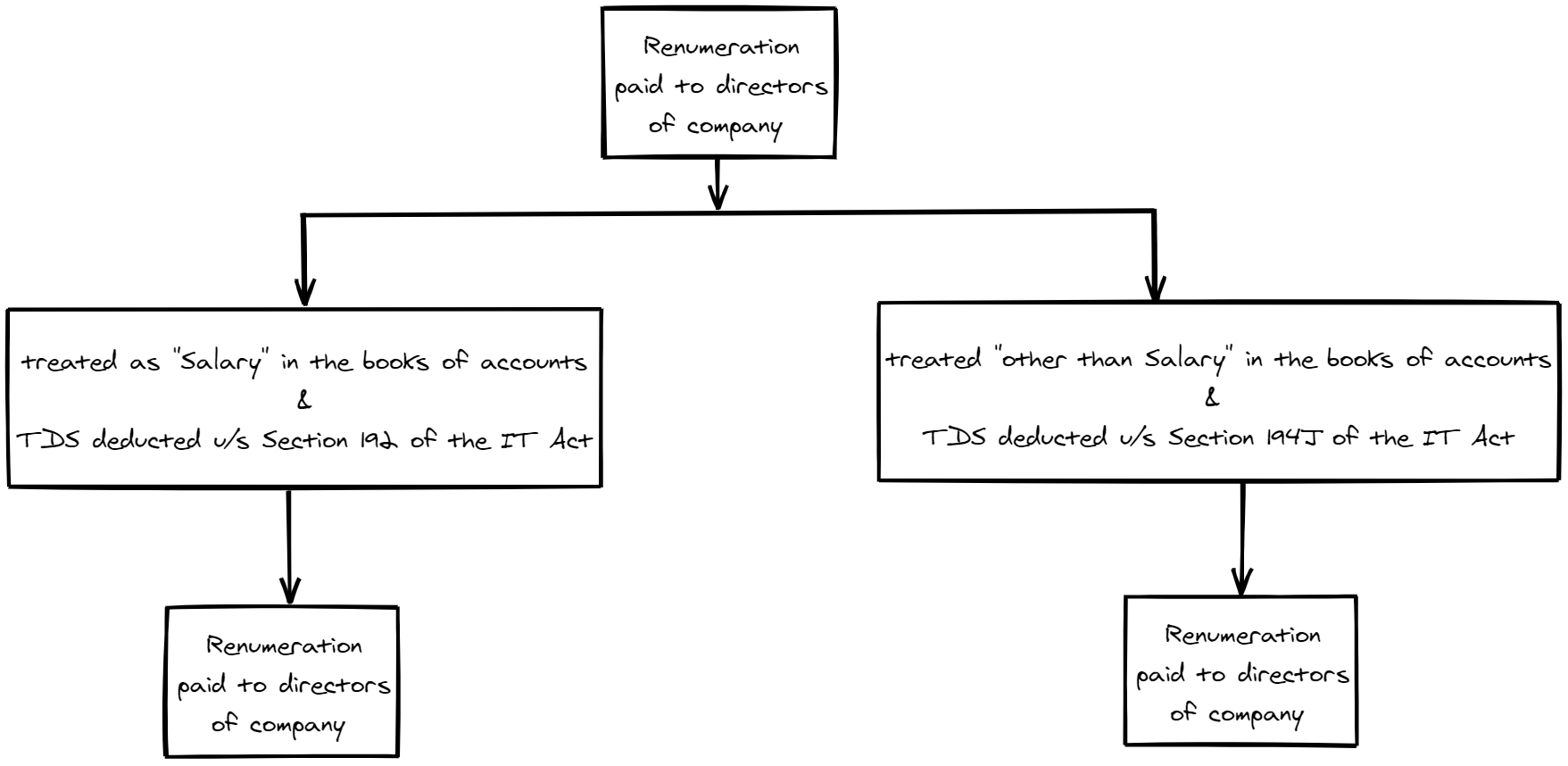

Both the advance rulings were criticized on separate ground and added more confusion among the taxpayers. In order to provide relief to the taxpayers, the Central Board of Indirect Taxes and Customs(CBIC) issued a clarification in this regard vide Circular No. 140/10/2020-GST dated 10th June, 2020. The government clarified that GST will be applicable on director’s remuneration only in cases where remuneration paid is declared separately other than “salaries‟ in the Company’s accounts and TDS under Section 194J of the Income Tax Act, 1961 as Fees for professional or Technical Services on it.

The GST implication on director’s remuneration can be explained with the help of the following flowchart:

Thus, it can be concluded that GST under RCM will be applicable on director’s remuneration when the remuneration paid is recorded as “Professional Fees i.e., other than salary” in the books of accounts of the Company.

Following is the circular issued by GST Policy Wing of Central Board of Indirect Taxes and Customs on levy of GST on Director’s remuneration: