GST has become the backbone of the Indian revenue system. Thus it is very important to understand each and every aspect or rules related to this indirect taxation system. In continuation to our blog series on GST, in this blog we will be discussing on the concept of Aggregate Turnover.

Definition

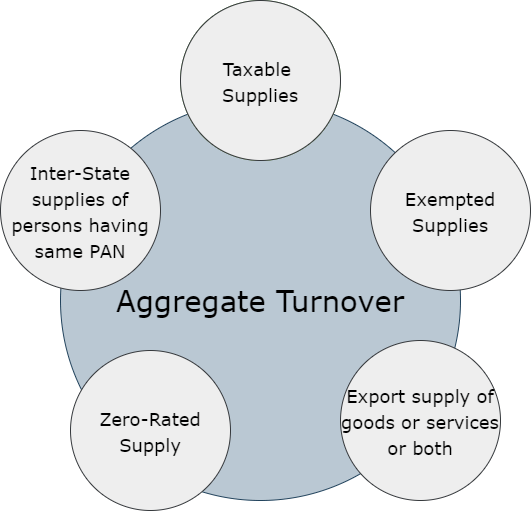

As per section (6) of the CGST Act, 2017, aggregate turnover means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess.

Aggregate Turnover is an all-embracing term covering all the supplies which are effected by a person having the same PAN in India. It also includes export supply made under the same PAN. The aggregate turnover is calculated to determine the threshold limit for registration under the GST Act and to determine the eligibility for composition scheme.

For example: MNP Pvt. Ltd. has branches in Guwahati and Jaipur. The principal place of business is in Delhi. To determine the aggregate turnover, the value of supplies made at Guwahati, Jaipur and Delhi have to be taken into account. If the aggregate turnover exceeds the threshold limit specified under GST(at present Rs. 40 Lakhs for supply of goods in normal category states), then MNP Pvt. Ltd. will be liable for registration under GST.

What is the importance of aggregate turnover under GST?

Aggregate turnover is calculated for the following purposes under GST:

- To determine whether liable for GST registration - if the aggregate turnover exceeds the threshold limits.

- To determine the eligibility to opt for composition scheme: if the aggregate turnover is upto Rs.1.50 crores in a financial year for goods supplier in normal category states.

- To determine the applicability of GST Audit. Annual Return is optional only for few in FY 2017-18 & 2018-19 based on aggregate turnover.

How to calculate aggregate turnover?

The term ‘aggregate turnover’ includes turnover of all branches under a single PAN. The calculation of the aggregate turnover has to be done on PAN India level and not on all GST registration number under single state basis. For calculating aggregate turnover, following supplies shall be added:

- Taxable supplies.

- Exempted supplies:

- Nil Rate supply of goods or services.

- supply of goods or services which are wholly exempt from GST u/s 11.

- supply of goods or services which are not taxable under the GST law eg. alcoholic liquor for human consumption, petroleum crude, high speed diesel, motor spirit etc.

- Export of goods or services or both, including zero-rated supplies.

- Inter-State supplies of persons having same PAN.

Note:

Supplies between units of a person with same PAN is included in aggregate turnover.

Supplies made by the agent on behalf of the principal shall be included in his aggregate turnover.

In case of job work, the supplies will not be included in the aggregate turnover of job-worker is:

a. Goods returned to the principal

b. Goods sent to another job worker on the instruction of the principal

c. Goods directly supplied from the job worker’s premises (by the principal).

All relevant supplies made under same PAN on all India basis shall be added.

Exclusions from aggregate turnover

Apart from the inclusions, there are certain items which are to be excluded if included in the turnover of the taxpayer:

- Inward supplies received by the recipient liable to tax under reverse charge mechanism

- Various taxes under the GST law viz, CGST, SGST, UTGST, Compensation cess etc.

Apart from the above exclusions no other supply or part of the supply will be excluded while calculating aggregate turnover.

The concept of aggregate turnover is very crucial to each and every registered or unregistered taxpayer. This is the very basis which determines whether a person is liable to take registration or not.