Supply is the most important elements for the applicability of GST on any goods or services. In our blog services on GST, we are trying to provide you with basic understanding on the various concepts under GST. In continuation to our previous blog, here we will discuss on two different varieties of supply.

There are two very different concept of supply - Composite Supply & Mixed Supply. In these two supplies two or more goods or services or both are supplied together. All the basic provisions of time of supply, invoicing, rate of tax etc. depends upon the nature of supply and hence it is important to understand the concept of these two supplies. In composite supply, the core substance is the ‘Principal Supply’ and in case of mixed supply it is ‘Supply with highest rate of tax’. We will discuss the various issues related to these supplies in a brief manner in this blog.

Importance of identifying Composite & Mixed Supply under GST

Under normal business scenarios there are many instances when two or more goods or services or both are supplied together for completing a supply. In those cases, it won’t be simple to identify the appropriate rate of tax. Thus, it is important to identify whether the supply is composite or mixed supply to determine the rate of tax applicable on the supply.

Definition

Composite Supply

‘Composite Supply’ means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

Principal Supply: Principal Supply means the predominant supply of goods or services, to which the other supplies are ancillary.

Mixed Supply

‘Mixed Supply’ means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply.

Features

Composite Supply

Supply should be made by a taxable person.

Two or more taxable supplies of goods or services or both.

Naturally bundled.

Factors to determine natural bundling:

- This type of bundling means the ancillary supply is only made to support the pre-dominant supply

- General practice in the industry.

- The supplier is generally not dealing in ancillary supply under the normal course of business.

- The different components are not separately available for supply.

Ordinary course of business.

Supply deemed to be of Principal Supply.

All other goods or services are supplied ancillary with the principal supply.

Mixed Supply

- Supply should be made by a taxable person.

- Two or more individual supplies of goods or services or both. It can include both taxable and non-taxable supplies.

- Supplied for a single price in the ordinary course of business.

- Supply does not constitute composite supply i.e;, they are not naturally bundled.

Tax treatment under GST along with examples

Composite Supply:

- Supply shall be treated as that of Principal Supply.

- Rate of Tax: As applicable on Principal Supply.

- All the provisions that of time of supply, invoicing, place of supply, value of supply, rate of tax etc. shall all be determined in respect of the principal supply.

Examples

Work Contract service have been specifically mentioned as composite supply under Schedule II of the CGST Act, 2017.

In case of supply of goods with packaging, transportation and insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply.

Hotel Stay with complimentary breakfast in the hotel industry is natural bundled and the principal supply of hotel room rent is only charged by the supplier.

Supply of certain goods along with erection and installation of the same thereto is also composite supply where the principal supply is that of goods and not services.

Supply of Carry bag with vegetables(assumed to be free of cost) in super markets is composite supply and to be treated as supply of vegetables only.

Booking of train ticket where meal is complimentary is an example of composite supply.

Mixed Supply:

- Supply shall be treated of that particular supply which attract highest rate of tax.

- All the provisions that of time of supply, invoicing, place of supply, value of supply, rate of tax etc. shall all be determined in respect of that supply which attracts the highest rate of tax.

Note: In case more than one component of the mixed supply attract highest rate of taxes, the law does not prescribe for treatment of the transaction as to which component supply it is to be treated. For example:

Examples

UPS and battery is to be considered as mixed supply as they are supplied under a single contract at a combined single price.

Supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drink and fruit juices when supplied for a single price is a mixed supply.

Tooth paste is bundled along with a tooth brush and is sold as a single unit for a single price, it would be treated as a mixed supply.

Supply of laptop and printer is not naturally bundled and can be supplied separately. It will be treated as mixed supply and highest tax rate will be applicable.

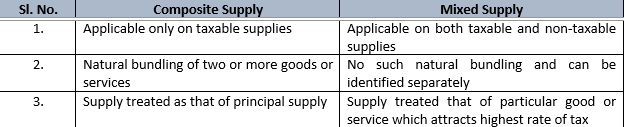

Difference Between Composite & Mixed Supply

Form the above discussion we get to know the importance of identifying the right type of supply for determining the right tax structure. We can conclude that a supply can be a mixed supply only if it is not a composite supply and there is no natural bundling.