Prime Minister Narendra Modi launched a platform for ‘Transparent Taxation - Honoring the Honest’ on August 13, 2020. The new platform will include faceless assessments, faceless appeal and Taxpayer charter.

The new faceless assessment is aimed to bring more transparency, simplification and confidence among the honest taxpayers. The new scheme proposes setting up of National e-Assessment Centre(NeAC) and Regional e-Assessment Centers for the implementation of the complete faceless assessment process. The NeAC will act as the communication channel between the department and the taxpayer/assessee/third-party.

In the last 5 years many significant direct tax reforms have been announced by the CBDT for simplification of the Indian Income Tax structure. At the launch event, PM said that the focus of the Government in the last six years has been “Banking the Unbanked, Securing the Unsecured and Funding the Unfunded”.

Some of the relief measures announced in the recent years:

- Reduction of Corporate Tax Rate to 15% for the new manufacturing units and 22% for other units.

- Removal of dividend distribution tax and making dividend taxable in the hand of the recipient.

- Prefilled Income Tax forms to make compliances convenient for taxpayers.

- Vivad Se Vishwas Scheme.

- Thresholds limit for filing of appeals in various appellate Courts have been raised.

- Extension of statutory due dates in the time of pandemic.

- E-assessment Scheme 2019

E-assessment Scheme 2019 was launched by PM Modi to push the IT department towards paperless assessments. Continuing on the same path, and bring more transparency and trust of taxpayers, the government has now launched ‘faceless assessment’.

The main elements of this new reform are:

- Seamlessness

- Fairness

- Fearless

- Faceless

The Central Board of Direct Taxes vide Notification No. 60/2020 dated 13th August 2020 and Notification No. 61/2020 dated 13th August 2020 revised the assessment procedures and introduced ‘Faceless Assessment’ in place of ‘E-assessment Scheme 2019’. The main objective of launching this revised assessment scheme was to stop bureaucratic influence in assessments and thus gaining the trust of honest taxpayers in Income Tax Assessments and appeals. In this scheme, the NeAC will do all communications from the department to the taxpayer/assessee/third-party.

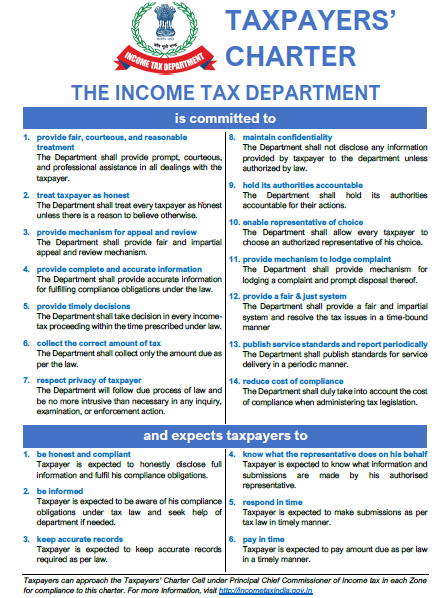

Some of the important elements of this new platforms are:

- Faceless Assessments

- Faceless Appeals

- Taxpayers Charter

- Assessment orders without DIN will be invalid

- Automated selection of assessment irrespective of the city of the taxpayer.

- National e-assessment center to serve notices for scrutiny and assessments.

- Selection of cases through data analytics and Artificial Intelligence.

- No face to face communication between ITO and Taxpayer.

The new revised assessment procedure effective from 13th august 2020 shall including setting up of New National e-Assessment Center which will serve as a communication channel between the IT department and the assesses. Further best judgement assessment shall also be included in the scope of faceless assessment. The NeAC(National e-Assessment Centre) will be set up at Delhi and 20 ReACs(Regional e-Assessment Centre) will be set up all over the Country. The ReAC will include four divisions:

- Assessment Unit,

- Verification Unit,

- Review Unit, and

- Technical Unit.

With regard to setting up on NeAC and various ReACs, the CBDT has further issued the following Notifications:

- Notification No. 62/2020 dated 13th August 2020

- Notification No. 63/2020 dated 13th August 2020

- Notification No. 64/2020 dated 13th August 2020

- Notification No. 65/2020 dated 13th August 2020

- Notification No. 66/2020 dated 13th August 2020

CBDT has further issued Guidelines for implementation of the faceless assessment scheme 2019.

The National e-Assessment Centre shall serve a notice to the assessee specifying the issues for selection of his case for assessment. The center shall assign the cases selected for the purposes of e-assessment to a specific assessment unit through an automated allocation system.

The new faceless assessment procedure talks about electronic records shall be authenticated by National e-Assessment Centre by affixing its digital signature and the assessee shall shall submit it records by affixing his/her digital signature or by using Electronic Verification Code.

To conclude we can say that this new assessment process will bring in more transparency in the already existing e-assessment procedure.