GSTR 3B is a monthly GST return to be filed by regular taxpayers. It is a summary return by which GST liability is discharged by taxpayers.

Features of GSTR 3B

- Summary return.

- Monthly self-declaration to be filed by 20th of the following month.

- Discharging of due GST liability.

- Nil Return to be filed even if there is no business activity.

- Reporting of Outward Supply, Inward Supply, ITC etc.

- GSTR 3B once filed cannot be revised.

- GSTR 3B figures wrongly reported in the previous month can be corrected in current month GSTR 3B.

- Late filing Fees of Rs. 50 per day or Rs. 20 per day(in case of nil return) is applicable .

- Nil GSTR 3B can be filed via sms also from 8th June 2020. onwards. The complete process has been already explained in our blog.

Updates related to GSTR 3B

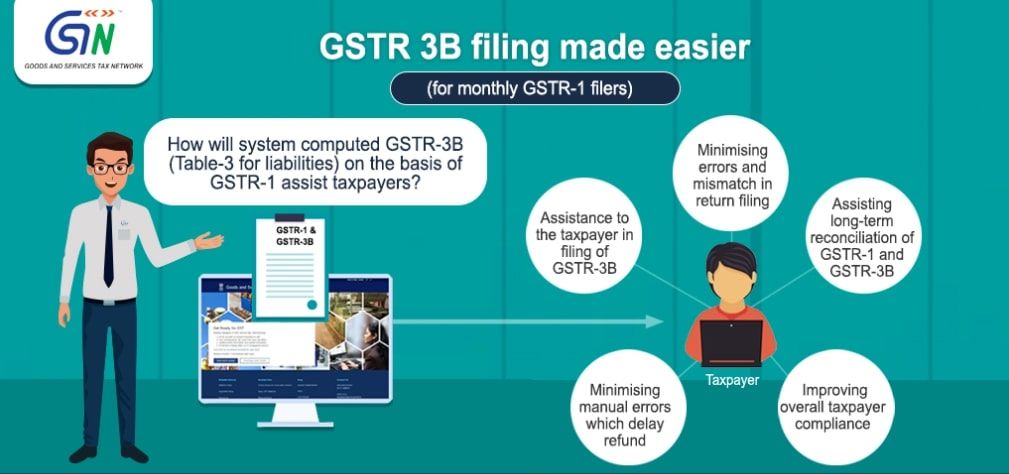

The Goods and Services Tax Network(GSTN) are continuously developing their technologies to ease the compliance burden of taxpayers. Various important amendments have been in the GSTR 3B filing process from the month of August’ 20 onwards. These new features will avoid the discrepancies between GSTR 1 and GSTR 3B:

- System computed GSTR 3B liability (Table 3) based on the GSTR 1 filing of the taxpayer.

- Applicable only in case of taxpayers filing monthly GSTR 1.

- Auto-populated figures can be downloaded in pdf format of GSTR 2B. These figures can be verified, edited and correct figures can be reported.

- Auto-population feature is mere assistance at present for ease of compliances.

- The auto-populated GSTR 3B pdf will be available within minutes of filing of GSTR 3B. Hence it is not a time consuming process.

- GSTR 3B will now accept negative figures in Table 3 which will help in correcting errors made in previous month GSTR 3B.

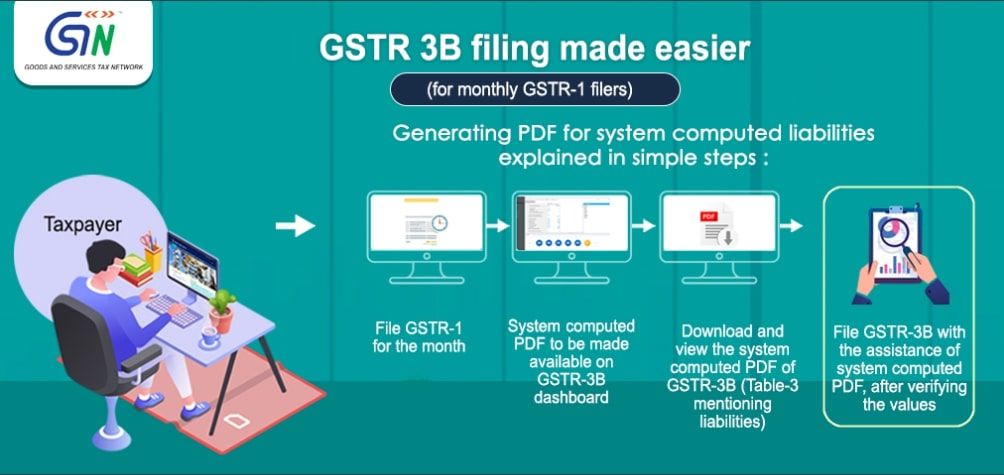

Process of filing of GSTR 3B using the auto-populated values in GSTR 3B

- Upload GSTR 1 for the particulars month.

- GST system auto computed GSTR 3B will be available for download in pdf format.

- The pdf will be available on the GSTR 3B dashboard.

- View the downloaded pdf and check the auto-computed liability.

- File GSTR 3B with the assistance of the auto-computed figures. Verify, edit and report the correct figures.

- Make the required tax payment.

- File the return.

The GSTN is continuously updating their system to ease the taxpayer compliance system. All these updates will help the taxpayers in making timely compliances without much delay and reducing the errors in GST returns.